May 2, 2025

What Makes a Good LBO Candidate

Published on

May 2, 2025

Table of Content

What is an LBO?

A leveraged buyout (LBO) is a strategic financial transaction where a company is acquired primarily through borrowed funds. In this process, a private equity firm or a consortium of investors secures a controlling interest in the target company by leveraging debt to finance a significant portion of the acquisition cost.

Selecting the right LBO candidate is critical, as success depends on the target company's ability to generate enough cash flow to service debt and provide investor returns. A thorough evaluation of the company's financial health, market position, management, and growth prospects is key to ensuring a successful LBO. When selecting the optimal LBO candidate, consider the essential factors.

1. Strong and Predictable Cash Flows

One of the key traits of an ideal LBO candidate is the ability to generate strong, predictable cash flows. A company with reliable, recurring cash flows is better equipped to meet its debt obligations and support the success of the transaction.

When assessing a potential LBO target, private equity firms and investors closely examine key metrics such as free cash flow (FCF), operating cash flow (OCF), and earnings before interest, taxes, depreciation, and amortization (EBITDA). These metrics are critical for evaluating the company's capacity to generate operational cash and its overall financial stability. Companies with strong cash flows often exhibit the following characteristics:

Recurring Revenue Streams

Businesses with a significant portion of their revenue coming from recurring sources, such as subscriptions, maintenance contracts, or long-term customer relationships, tend to have more predictable cash flows.

High Operating Margins

Companies with high operating margins are generally more efficient and can generate more cash from their operations, making them attractive LBO candidates.

Low Capital Expenditure (CapEx) and Working Capital Requirements

Businesses that do not require significant capital investments or have low working capital needs are more likely to have higher free cash flows available for debt servicing and investor returns.

Diversified Customer Base

Companies with a diversified customer base across different industries, geographies, or product lines are less vulnerable to market fluctuations and can maintain more stable cash flows.

Examples of industries with strong and predictable cash flows that have been successful LBO targets include cable and telecommunications providers and consumer packaged goods companies with established brands and loyal customer bases.

It is important to note that while strong cash flows are desirable, they should also be evaluated in conjunction with other factors, such as growth potential, market position, and the ability to implement operational improvements to further enhance cash flow generation.

2. Stable Customer Base and Barriers to Entry

Companies with a loyal and recurring customer base tend to have more predictable revenue streams. Characteristics of a stable customer base include long-term contracts, high customer retention rates, and a diversified customer portfolio across different industries or geographic regions.

Companies that also operate in industries with high barriers to entry are more attractive LBO targets because they face less competition and have a stronger market position. Types of barriers to entry include:

Regulatory barriers

Industries with stringent regulations, licensing requirements, or government oversight tend to have higher barriers to entry, as new entrants must navigate complex legal and compliance hurdles.

Capital requirements

Industries that require significant upfront capital investments, such as manufacturing or infrastructure, can deter new competitors due to the high costs involved.

Proprietary technology or intellectual property

Companies with proprietary technologies, patents, or trade secrets enjoy a competitive advantage and can make it challenging for new entrants to replicate their offerings.

Brand recognition and customer loyalty

Established brands with strong customer loyalty and recognition can create barriers to entry, as new competitors must invest heavily in marketing and advertising to gain market share.

Examples of industries with high barriers to entry that can be attractive for LBOs include:

- Telecommunications: Significant infrastructure and regulatory requirements.

- Pharmaceuticals: Extensive research and development costs, patent protection, and regulatory approvals.

- Utilities: Monopolistic or oligopolistic market structures, regulatory oversight, and large infrastructure investments.

- Software and technology: Proprietary technologies, network effects, and high switching costs for customers.

- Accounting Firms: High regulatory barriers created from AICPA requirements, customer loyalty, recurring revenue from annual compliance cycle

3. Experienced and Qualified Management Team

A seasoned and capable management team is a crucial factor in the success of a leveraged buyout. The target company's existing management plays a huge role in the due diligence process, transition, and subsequent operation under the new ownership structure.

Importance of a Strong Management Team

The management team's experience, expertise, and leadership abilities are critical in navigating the complexities of an LBO. They need to have a deep understanding of the company's operations, industry dynamics, and competitive landscape. A strong management team will effectively execute the strategic plans and operational improvements envisioned by the private equity firm, ensuring a successful post-acquisition integration.

Qualities to Look for in Management

When evaluating a potential LBO candidate, private equity firms should assess the management team's track record, industry reputation, and alignment with the firm's goals. Key qualities to look for include:

- Proven Leadership: A management team with a demonstrated ability to make tough decisions, adapt to changing market conditions, and drive growth is highly desirable.

- Industry Expertise: Intimate knowledge of the industry, its trends, and competitive forces is crucial for identifying opportunities and mitigating risks.

- Financial Acumen: A strong grasp of financial metrics, budgeting, and cost management is essential for maximizing profitability and cash flow generation.

- Operational Excellence: Expertise in streamlining operations, improving efficiencies, and optimizing processes can unlock significant value in an LBO.

- Strategic Vision: The management team should have a clear strategic vision for the company's future growth as well as the ability to excuse

Role of Management in LBOs

The management team plays a critical role throughout the LBO process, from initial due diligence to post-acquisition integration and value creation. Their involvement and commitment are crucial for the success of the transaction. Specific roles may include:

- Due Diligence Support: Providing detailed information about the company's operations, financials, and strategic plans to aid in the evaluation process.

- Transition Facilitation: Ensuring a smooth transition during the ownership change, maintaining business continuity, and retaining key personnel.

- Strategic Execution: Implementing the strategic plans and operational improvements outlined by the private equity firm to drive growth and profitability.

- Value Creation: Identifying and capitalizing on opportunities for cost optimization, revenue enhancement, and operational efficiencies.

- Rollover Equity: In many cases, the management team is incentivized to roll over a portion of their equity stake, aligning their interests with the new owners and promoting long-term success.

By prioritizing a strong, experienced, and qualified management team, private equity firms can increase the chances of a successful LBO and maximize the value creation potential of the target company.

4. Room for Margin Improvement

Private equity firms seek companies with potential for margin improvement through operational enhancements. Key opportunities include streamlining operations, cutting costs, and boosting efficiency.

Evaluating margin improvement potential is essential when assessing an LBO target. This involves scrutinizing the company's cost structure, supply chain, manufacturing processes, and overall operational efficiency. Identifying areas where costs can be optimized, redundancies removed, and productivity elevated is fundamental for enhancing margins.

Operational changes that can lead to margin improvement include:

Cost Optimization – Renegotiating supplier contracts, consolidating procurement, and implementing lean manufacturing practices can significantly reduce operational costs.

Process Streamlining – Analyzing and redesigning business processes to eliminate waste, improve workflow, and increase efficiency can drive productivity and lower costs.

Automation and Technology Integration – Investing in automation technologies, such as robotics and software solutions, can reduce labor costs and improve operational efficiency.

Organizational Restructuring – Streamlining the organizational structure, eliminating redundant roles, and optimizing resource allocation can lead to cost savings and improved productivity.

Supply Chain Optimization – Reviewing and optimizing the supply chain, from sourcing to distribution, can reduce inventory costs, improve logistics, and enhance overall efficiency.

Successful LBOs frequently involve companies that have proven their ability to enhance margins post-acquisition. Michaels Stores, a prominent arts and crafts retailer, implemented a comprehensive cost-cutting strategy after its LBO in 2007. This included renegotiating supplier contracts, optimizing store operations, and streamlining its distribution network, resulting in notable margin improvements and increased profitability.

Similarly, the LBO of Univar Solutions, a global chemical distributor, in 2015 saw the new owners drive operational efficiency through supply chain optimization, process automation, and organizational restructuring. These initiatives led to significant margin enhancements and improved cash flow.

When evaluating an LBO candidate, private equity firms meticulously assess the potential for margin improvement and formulate a detailed operational enhancement plan. Companies with a clear strategy for margin improvement are often deemed ideal LBO targets, as these enhancements can lead to substantial value creation and appealing returns for investors.

5. Low Capital Expenditure and Net Working Capital Needs

Importance of Low CapEx and NWC Needs

Companies with low CapEx (Capital Expenditure) needs typically operate in asset-light industries or have already made significant investments in their infrastructure, facilities, and equipment. This means they do not require substantial ongoing capital investments to maintain operations or drive growth. As a result, more cash can be allocated towards debt repayment and equity distributions.

Similarly, businesses with low NWC (Net Working Capital) requirements have a favorable working capital cycle, where they can collect cash from customers faster than they need to pay suppliers and cover other operational expenses. This positive cash conversion cycle generates additional liquidity, which can be used to meet debt obligations and fund growth initiatives.

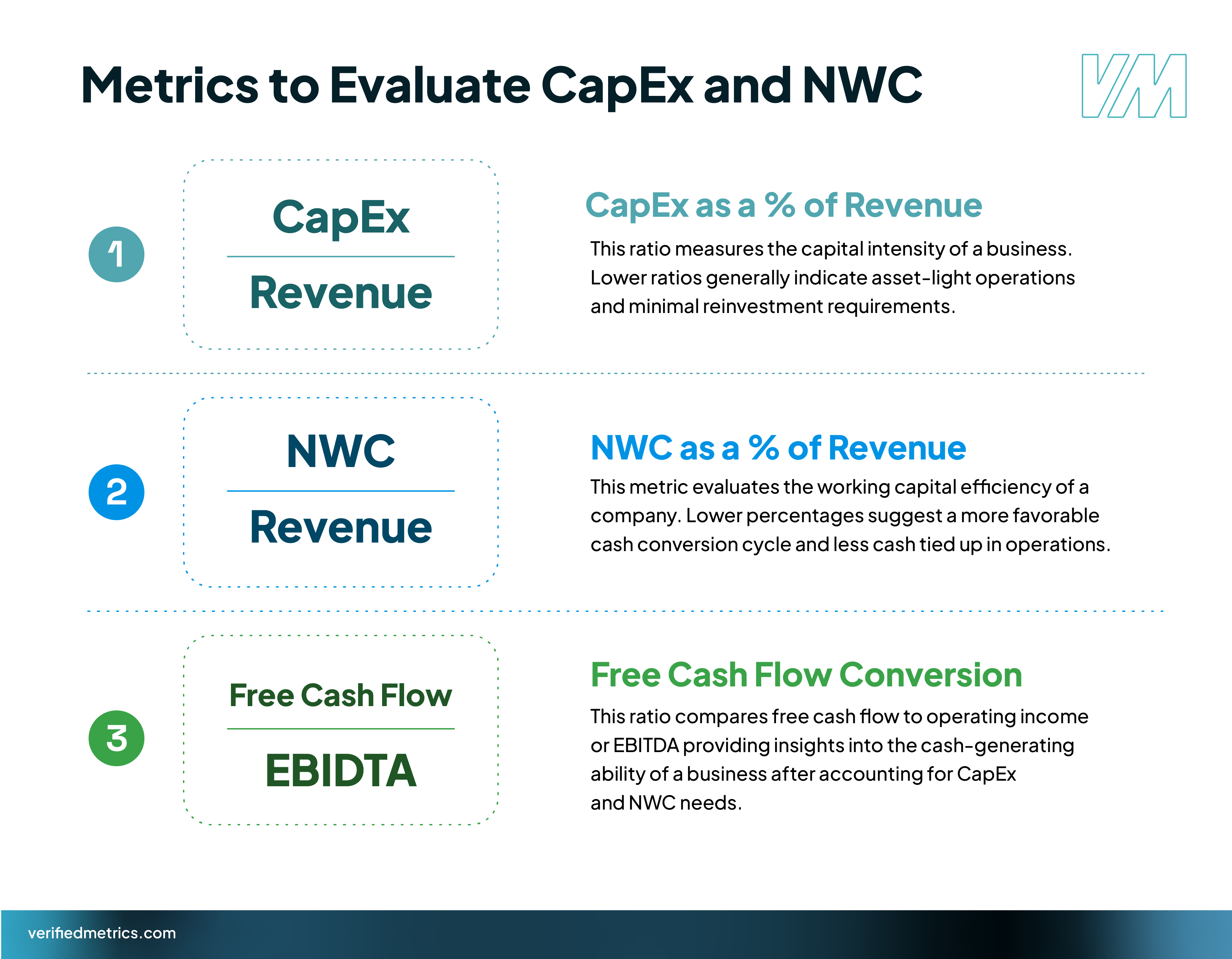

Metrics to Evaluate CapEx and NWC

Examples of Low CapEx/NWC Industries

- Software and technology services

- Business services (e.g., consulting, staffing, outsourcing)

- Healthcare services (e.g., hospitals, clinics, nursing homes)

- Media and entertainment

- Consumer services (e.g., restaurants, retail, hospitality)

These industries often have minimal physical asset requirements, rely heavily on human capital, and benefit from recurring revenue streams, making them well-suited for LBO transactions.

6. Growth Opportunities

Identifying Growth Potential

When evaluating a potential LBO target, investors carefully assess the company's growth prospects. This includes analyzing factors such as market trends, competitive landscape, product or service demand, and untapped customer segments. Companies with a strong market position, innovative offerings, and a loyal customer base often have a higher potential for organic growth.

Additionally, companies operating in industries with favorable tailwinds, such as emerging technologies, changing consumer preferences, or regulatory changes, may present attractive growth opportunities. Private equity firms typically conduct extensive market research and competitive analysis to identify these growth drivers.

Examples of Companies that Grew Post-LBO

Many companies have experienced significant growth following an LBO, thanks to the strategic initiatives and resources provided by private equity firms. Some notable examples include:

- Burger King: Burger King implemented operational improvements, menu innovations, and international expansion strategies after an LBO by 3G Capital in 2010, leading to substantial growth in revenue and profitability.

- Michaels Stores: Following an LBO by Bain Capital and Blackstone Group in 2006, Michaels Stores, a leading arts and crafts retailer, expanded its store footprint, enhanced its e-commerce capabilities, and introduced new product lines, driving significant growth.

- Petco: After an LBO by CVC Capital Partners and CPPIB in 2015, Petco focused on expanding its services, enhancing its omnichannel capabilities, and acquiring complementary businesses, resulting in substantial revenue growth and market share gains

7. Solid Asset Base as Collateral

A solid asset base can serve as collateral for the significant debt financing involved. Lenders typically seek tangible assets to secure loans, reducing default risk. An ideal LBO candidate should possess substantial assets to offer as collateral to enhance the likelihood of securing favorable financing terms.

The types of assets commonly used as collateral in LBOs include real estate, machinery, equipment, inventory, and intellectual property rights. Asset-heavy industries such as manufacturing, real estate, and natural resources are often attractive LBO targets due to their substantial tangible asset holdings.

For instance, a manufacturing company with multiple production facilities, specialized equipment, and a significant inventory of raw materials and finished goods would be an ideal LBO candidate due to its strong asset base. Likewise, a real estate firm with a portfolio of commercial properties or a mining company with proven reserves and extraction equipment would offer substantial collateral for an LBO transaction.

It's important to note that not all assets are equally valuable as collateral. Lenders typically prefer assets that are easily liquidated, have a stable market value, and are not subject to rapid depreciation or obsolescence. Additionally, the asset base should be well-maintained and have a clear ownership structure to facilitate the collateralization process

8. Strong Market Position

Companies with a dominant or leading position in their respective markets tend to have several advantages that make them more attractive for a leveraged buyout.

Indicators of a Strong Market Position

- High market share: A company with a significant share of the total market demonstrates its ability to outperform competitors and maintain a strong customer base.

- Brand recognition and loyalty: Well-established brands with a loyal customer following are less susceptible to competition and can command premium pricing.

- Pricing power: Market leaders often have the ability to dictate prices, translating into higher profit margins and better cash flow generation.

- Economies of scale: Large market players can benefit from economies of scale, reducing their production costs and improving profitability.

Advantages of a Strong Market Position

- Barrier to entry: A dominant market position creates significant barriers to entry for new competitors, protecting the company's market share and cash flows.

- Pricing power: Market leaders can often raise prices without losing significant market share, allowing them to maintain or improve profit margins.

- Customer stickiness: Customers tend to be loyal to market leaders, reducing the risk of customer churn and ensuring a stable revenue stream.

- Negotiating power: Strong market positions give companies leverage when negotiating with suppliers, further improving profitability.

Examples of Market Leaders in Different Industries

- Retail: Walmart, Amazon, Costco

- Technology: Apple, Microsoft, Google

- Consumer goods: Procter & Gamble, Unilever, Coca-Cola

- Pharmaceuticals: Johnson & Johnson, Pfizer, Merck

- Automotive: Toyota, Volkswagen, General Motors

LBO Capital Structure

The capital structure in an LBO is a crucial aspect that determines the success of the transaction. It involves a careful balance of debt financing and equity contribution, both of which play vital roles in the overall strategy.

Debt Financing

Debt financing is the cornerstone of an LBO, as it allows the acquirer to leverage a significant portion of the purchase price. Private equity firms typically raise debt from various sources, including banks, institutional lenders, and the issuance of high-yield bonds. The amount of debt raised is determined by the target company's cash flow and the lenders' assessment of the risk involved.

The debt financing in an LBO is typically structured in multiple tranches, each with different terms, interest rates, and repayment schedules. Common tranches include senior secured debt, mezzanine debt, and subordinated debt. The senior secured debt is the highest-ranking and least risky tranche, while the subordinated debt carries the highest risk and, consequently, higher interest rates.

Equity Contribution

While debt financing provides the bulk of the capital required for an LBO, equity contribution is also essential. The equity contribution typically comes from the private equity firm's own funds, as well as co-investors such as pension funds, sovereign wealth funds, and high-net-worth individuals.

The equity contribution serves as a buffer against potential risks and helps maintain a sustainable capital structure. It also demonstrates the private equity firm's commitment to the transaction and aligns their interests with those of the lenders and other stakeholders.

Deleveraging and Exit Returns

One of the primary goals of an LBO is to deleverage the acquired company over time, reducing its debt burden and improving its financial health. This is typically achieved through a combination of operational improvements, cost-cutting measures, and strategic initiatives that enhance the company's profitability and cash flow generation.

As the company's financial performance improves and debt is paid down, the private equity firm can explore exit strategies, such as an initial public offering (IPO) or a sale to a strategic buyer. The successful deleveraging and exit strategies determine the overall returns for the private equity firm and its investors.

Examples of Successful LBO Capital Structures

One notable example of a successful LBO capital structure is the acquisition of Hilton Hotels by Blackstone Group in 2007. The $26 billion transaction involved $20 billion in debt financing and $6 billion in equity contribution. Over the following years, Blackstone implemented various operational improvements and deleveraging strategies, ultimately taking Hilton public in 2013 and generating significant returns for its investors.

Another example is the LBO of Neiman Marcus by TPG Capital and Warburg Pincus in 2005. The $5.1 billion transaction involved $3.2 billion in debt financing and $1.9 billion in equity contribution. While the company initially struggled with its debt burden, the private equity firms implemented strategic initiatives, such as expanding the company's e-commerce presence and streamlining operations, which eventually led to a successful deleveraging and exit through an IPO in 2015.

Final Thoughts and Advice

Identifying an ideal LBO candidate requires a deep understanding of the target company, its industry, and broader market dynamics. While the criteria outlined here offer a strong foundation, the best practice is to approach each opportunity with a critical perspective and adaptability to evolving conditions.

Ultimately, there is no such thing as a perfect LBO candidate and the success of an LBO depends on balancing risk and reward. While the potential for substantial returns is compelling, thorough due diligence and a well-structured capital framework are essential for managing risks effectively.